OfferGet 10% off on Dissertation, Assignments, Essays, Thesis

This paper aims to assess the impact of Emerging economies on global business in retail and luxury goods sector. It has been identified through this paper that emerging economies provide lucrative business environments to the industries and hence most of the global businesses select emerging economies for their business development and expansion. It is hence seen that while some factors of the business economies may promote one type of industry, the same factor may act as a limiting factor for the other industry. It is also seen that some of the common benefits which are offered by the emerging economies to MNEs are cheaper labour, inexpensive supply chains, free trade economies and emerging markets for the products. On the other hand, it is also seen that the governmental regulations and legislations also act as limiting factors for the MNEs as well. This discussion has been supported with different, examples taken from the retail and luxury industry in order lend weightage to the arguments which have been made.

Emerging Markets are also called as Emerging economies and mainly pertain to the reference made to developing countries, where in the countries tend to invest higher in increase of productive capacity. There remains a divergent route from the traditional economies which are more agriculture based and depend upon export of raw materials. However, in this case, it is seen that emerging economies progressively create a better quality of life for the people by adopting free markets and mixed economies. Cui et al. (2014) deliberate the importance of emerging markets as such countries are important for driving growth in the global economy. In addition to the same, the emerging economies present various opportunities and risks as far as the development and growth of the Multinational Enterprises is concerned owing to impact of different political and economic systems in such countries. In addition to this, it is also observed that a factor which presents itself as an opportunity for MNEs in a particular emerging economy for one industry may prove to be a risk for the other industry. In this regard, a comparative discussion based on retail industry and Luxury goods depicts a contrast in terms of the impacts which emerging economies may have on MNEs in such industries (Pradhan 2017).

Beginning with an introduction to the concepts and theories of Emerging economies, this paper aims to present a critical analysis of the different opportunities and risks which impact the entry and growth of MNEs in emerging economies. While the opportunities have been identified and risks have been highlighted, in order to draw comparative inferences, the Luxury goods industry and retail industry MNEs in different emerging economies have been compared.

Emerging Market Economy (EME) is a broad term which has been defined by different scholars based on the aspects of economy which were evaluated by them. Nelson (2017) defines emerging market economies as economies which are still developing, whereas according to Lall, (2016) there are three criteria which should be fulfilled for classifying the economy into this category.

As per this definition, the first criteria which should be met in order to define an economy as emerging is the Absolute Level of economic development, which can be measured with through GDP or through the balance derived between industrial and agrarian activity contributing to the GDP.

As per this definition, an economy which displays low to middle level per capita income, can be classified as an Emerging Economy. This definition has also been supported by Antoine Agtmael of the International Finance Corporation of the World Bank. As per this criterion, countries such as India and China belong to this category as 80% of the global population represents the 20% of the global economies (Wiedmann et al. 2015). Another criterion which can be used to measure the Emerging Economy is the rate at which GDP grows. And lastly, the third criterion which can be used is the system applied to the market governance and the regulations which are applied. Hence the stability of the free market system determines the nature of the economy and in this case, the term transitional economy is also applied in cases where the economy is progressively moving from a command economy to a more free and liberal market.

However, it is seen that the first criterion is the most commonly used and as per the classification made by World Bank, less than $765 are considered low economies and 63 counties belong to this category. Lower middle is classified as between $765 to $ 3,035 and 65 countries belong to this category. Upper Middle economies are 30 countries which have a range of $3,036 to $ 9385 and more than this level are high economies with 50 countries belonging to this category (Helliwell, Layard and Sachs 2014). India, Vietnam and China are the only thee big Emerging Economies which are also classified as low category countries.

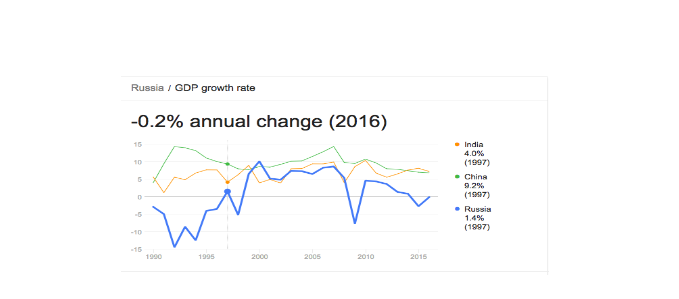

It is also seen that 800 million people of the global population live in developed countries. The second criterion which refers to the GDP growth rate is higher in case of emerging economies as compared with developed economies. This is evident from the fact that an average annual GDP growth rate of 5% has been witnessed in emerging countries since 1990

Also, as per the third criterion, it is seen that the market government systems are assessed by the national investment risks and based on this classification, south Korea, India, China, Poland, Turkey and many other countries are classified as emerging economies.

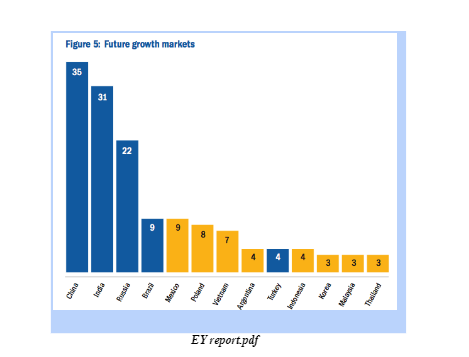

As per the definitions which have been provided above, it is seen that the scope of growth of economies is higher in case of developing nations as the scope of growth is visible. This may not hold true for the developed economies where in the economies are already exhausted. While referring to the retail sector, apart from the fact that his sector thrives on the customer preferences and habits, it is also seen that this industry is largely dependent upon procurement, manufacture and distribution of the goods being sold. Therefore, a lucrative business environment is found in emerging economies where the costing incurred is lower as compared with developed nations. On the other hand, it is also seen that as a contrast the customer groups, preferences and markets of the luxury goods industry are segregated and selling in the developed or emerging economies does not impact the business. Hence the following segments aim to identify and evaluate the risks and opportunities, offered by Emerging economies such as India and China to MNEs in the retail and luxury goods sector.

Multinational enterprises are characterised by presence in different countries and it is seen that that such companies are deeply impacted by the country of their presence, owing to the positive and negative impacts which the macro-environmental factors of such business environments can create. For instance, while referring to the business progress of retail MNE Marks and Spencer, UK, it is seen that the business environment of M & S in UK is different from the business environment provided in India (Jiang et al. 2015). Similarly, companies such as Levi’s and General Motors which are leaders in the Luxury goods industry entail a different business environment in USA as compared with multinational presence in countries such as China. However, apart from the fact that MNEs and their businesses are impacted by the presence in the Emerging economies, as per the Global Powers of Luxury Goods Report issues by Deloitt Global reveals that with an increase in spending capacity in the last five years, it is the customers in emerging markets which have increased the demand of luxury goods (Deloitt 2018). Therefore, while identifying the reasons attributed to the emergence of Multinationals in Emerging economies, the different reasons which have been attributed to the same are largely debatable.

As identified by Gilbert (2017) it is seen that since there remains a growth of upper middle class in Emerging economies, the markets for products from companies such as M&S, Levi’s General Motors, YSL and others are in demand in such countries. Coale and Hoover (2015) also state that a social inclination of the people, where in foreign goods are considered better than local goods also promotes the markets for such companies. Another reason which attracts MNEs from countries like USA and UK to emerging economies such as China and India remain the untouched territory where a presence of a brand can be easily established. This means that emerging economies provide ample opportunity for establishing a brand. In another observation which has been made by Leigh and Blakely (2016), it is seen that since emerging economies, are yet unexplored, there also remains sufficient scope to mediate the fluctuations in the economy. This means that by holding businesses in different locations the impacts of fluctuating economies are controlled.

Both in the retail and the luxury goods industry, a similarity of dependence of the industry on customer satisfaction and customer retention is identified (Cuervo-Cazurra and Ramamurti 2014). Emerging economies such as India, China and Thailand, may provide a lucrative, business environment in terms of cheap labour and smaller supply chains, they may not have the ability to provide, a dedicated market for the products in all cases. However, Leigh and Blakely (2016) contrasts this observation and states that the vice versa may also be possible. One of the basic business functions on Multinational Enterprises remains business process outsourcing and concurrently, with the views of Lahiri et al. (2014), it is seen that emerging economies such as India and China offer the best outsourcing opportunities for MNEs. For instance, by shifting manufacturing of Denims to countries such as Vietnam and China, it is seen that Levi’s was able to create a new market for its products in South East Asia along with the fact that production costs were controlled. Controlled costs led to reduced prices further increasing the market segment which could be targeted by Levi’s. Another opportunity which is offered by the emerging economies is Cheap Labour owing to differences in currencies and wage systems of the countries. Manpower and man-hours in emerging economies is much lower in costing, as compared with manpower and man-hours in developed nations. Assemblage and manufacturing of vehicles in countries such as India and China have benefitted companies such as General Motors and Hyundai Motors as apart from the distributed production reducing the supply chain, cheaper labour also reduces the costing incurred (Yamashita 2014). In terms of the technology shift which can be identified, it is seen that when MNEs enter emerging economies, better technology can be used at lesser price. This was one of the reasons why companies such as Amazon and Walmart are shifting their customer care projects to countries like India and China. As described by Demirbag et al. (2014) a strategic drift refers to the gap between the strategy adopted by the company and external environment which impacts the business. EMEs offer lesser strategic drifts for MNEs owing to the slower rate of development as compared with developed nations. This is also evident in the manner in which the supply chain logistics are better handled in Emerging Economies. For instance, in companies like Levi’s the costing of production, transport, and retail is reduced in EMEs such as India and China due to lower costing incurred. Lebedev et al. (2014) states that this is also dependent upon the currency and exchange rates which vary between EMEs and developed economies. This was also evident in companies such as Hyundai who were able to set up their manufacturing units in India and China and hence moved closer to European and American markets and reduced the length of the supply chain while the costing induced in manufacturing was also reduced.

While the discussion presented above, reflects the multitude of opportunities which are provided by emerging economies to the MNEs, Cuervo-Cazurra and Ramamurti (2014) argue that there are many risks, also which are posed by such economies. This is especially applicable to the retail industry where in the shelf life of the products may not always be extended where as in case of the luxury goods industry, the customer segments are not extensive and limited customers are found. Hence, it is also identified that risks in both the industries are basically pertaining to nature of the industry and the external environment.

The first aspect in this case which can be identified is the risk offered by Demographic and cultural differences between developed and emerging economies. In the retail industry, it is seen that the success of the industry depends upon the synchronisation between the products and the habits of the customers. Furthermore, for the retail industry to succeed, the preferences and patterns of purchase and manufacture vary across the two sets of economies. This is one of the reasons owing to which the US and UK based MNEs face challenges when they enter emerging markets. This can be identified through the case example when Tesco as a retail company failed in China owing to the cultural and structural differences between Home country and Host country in this case. When compared with the luxury industry on the other hand, it is seen that the same situation may not arise when the luxury goods industry is considered (Young et al. 2014). This is largely due to the fact that luxury goods industry has selected buyers in both the types of economies and the type of the economy does not impact the industry.

While referring to the economic and political risks which are offered, it is seen the emerging economies have a higher incidence of uncertainty and regulatory pressures. From the example of companies like Carrefour entering the Chinese market or companies, like Gucci and Chanel in their endeavours to spread distribution in China it is seen that companies were faced with political limitations in the form of FDI laws and regulatory frameworks (Biswas and Roy 2015). Hence it is seen that such risks remain common to both luxury and retail industries.

In terms of the competitive risks which can be identified, it is seen that both the industries face different types of risks owing to competition. Retail industry remains the most impacted owing to the fact that there are different local retailers in China which may be more successful as compared with MNEs. Examples include Yonghui Supermarkets, Hualian and Tmail. On the other hand, when applied to the luxury brands it is seen that global branding is the highest and hence local competition may not impact the business of the luxury goods industry. This shows that while local competition may hinder the progress of retail MNEs in emerging economies, the same does not apply to luxury goods sector.

From the discussion which has been presented, it is seen that there lies a broad difference between the developed economies and the emerging economies in terms of the business environments which are provided to the MNEs in such markets. It is also observed that while referring to the opportunities and challenges which are offered by such economies, the impacts on luxury goods industry and retail industry are largely different. This is mainly due to the difference in the nature of the goods provided by the two industries, in addition to the difference in the customer responses and behaviour which determine the success of the industry. In addition to the same, it is also seen that certain risks which limit the success of the retail industry may not impact the luxury goods industry and vice versa. Overall it is seen that emerging economies offer conducive business environments to the two industries baring a few factors which limit the growth of the industries.

Biswas, A. and Roy, M., 2015. Green products: an exploratory study on the consumer behaviour in emerging economies of the East. Journal of Cleaner Production, 87, pp.463-468.

Coale, A.J. and Hoover, E.M., 2015. Population growth and economic development. Princeton University Press.

Cui, L., Meyer, K.E. and Hu, H.W., 2014. What drives firms’ intent to seek strategic assets by foreign direct investment? A study of emerging economy firms. Journal of World Business, 49(4), pp.488-501.

Cuervo-Cazurra, A. and Ramamurti, R. eds., 2014. Understanding multinationals from emerging markets. Cambridge University Press.

Deloitte. (2018). Global Powers of Luxury Goods | Deloitte | global economy, Luxury Consumer. [Online] Available at: https://www2.deloitte.com/global/en/pages/consumer-business/articles/gx-cb-global-powers-of-luxury-goods.html [Accessed 4 Jan. 2018].

Demirbag, M., Collings, D.G., Tatoglu, E., Mellahi, K. and Wood, G., 2014. High-performance work systems and organizational performance in emerging economies: evidence from MNEs in Turkey. Management International Review, 54(3), pp.325-359.

Gilbert, D.L., 2017. The American class structure in an age of growing inequality. Sage Publications.

Helliwell, J.F., Layard, R. and Sachs, J., 2014. World happiness report 2013.

Jiang, Y., Peng, M.W., Yang, X. and Mutlu, C.C., 2015. Privatization, governance, and survival: MNE investments in private participation projects in emerging economies. Journal of World Business, 50(2), pp.294-301.

Lahiri, S., Elango, B. and Kundu, S.K., 2014. Cross-border acquisition in services: Comparing ownership choice of developed and emerging economy MNEs in India. Journal of World Business, 49(3), pp.409-420.

Lall, S., 2016. Developing countries in the international economy: Selected papers. Springer.

Lebedev, S., Peng, M.W., Xie, E. and Stevens, C.E., 2015. Mergers and acquisitions in and out of emerging economies. Journal of World Business, 50(4), pp.651-662.

Leigh, N.G. and Blakely, E.J., 2016. Planning local economic development: Theory and practice. Sage Publications.

Nelson, J.M., 2017. Access to power: Politics and the urban poor in developing nations. Princeton University Press.

Wiedmann, T.O., Schandl, H., Lenzen, M., Moran, D., Suh, S., West, J. and Kanemoto, K., 2015. The material footprint of nations. Proceedings of the National Academy of Sciences, 112(20), pp.6271-6276.

Yamashita, N., 2016. A comparative study of global production sharing in the automotive industry in China and India. Managing Globalization in the Asian Century: Essays in Honour of Prema-Chandra Athukorala, p.163.

Young, M.N., Tsai, T., Wang, X., Liu, S. and Ahlstrom, D., 2014. Strategy in emerging economies and the theory of the firm. Asia Pacific Journal of Management, 31(2), pp.331-354.

Uniresearchers is a leading team of researchers in the field of academic writing. With the track record of delivering 500+ high quality dissertations and 2500+ essays, assignments and coursework’s Uniresearchers has always tried to keep up with the expectations of our clients.

Uniresearchers is a leading team of researchers in the field of academic writing. With the track record of delivering 500+ high quality dissertations and 2500+ essays, assignments and coursework’s Uniresearchers has always tried to keep up with the expectations of our clients.